Download Transforming the Multifamily Sector: The Impact of Artificial Intelligence

Start Investment Process

Ashcroft Capital offerings are limited to accredited investors.

What is AVAF3?

The Ashcroft Value-Add Fund III focuses on capital preservation and risk mitigation while still having upside potential.

What are the investment criteria?

What are the targeted fund returns and projections?

5-7 Years

ANTICIPATED LIFE OF FUND

$25,000

MINIMUM INVESTMENT

Investment Criteria

| Communities located in the growth markets of the Sun Belt including Dallas-Fort Worth, Atlanta, and Orlando. | |

| Class A/B properties with an excellent opportunity for value creation through improvements | |

| Under performing or distressed multifamily properties | |

| 200+ Unit assets in highly desirable submarkets | |

| $20 million to $150 million total capitalization per property |

(Avg including sale)

13% to 20%

(Avg excluding sale)

6.0% to 8.0%

(Avg excluding sale)

6.0% to 8.0%

1.45x to 2.0x

Annual Cash-on-Cash Projections**

Year 1:4.0% |

Year 2:6.3% |

Year 3:7.0% |

Year 4:7.5% |

Year 5:8.0% |

*Based on 5 year hold for Class B Limited Partner Investment. Target returns represent ranges for base case, downside, and upside scenarios.

**Projected cash-on-cash returns are based on base case assumptions for the properties within the Fund

Note: Projected returns are based on LP levels of Fund.

Limited Partner (A) - Class A

Class A Limited Partner’s earn a coupon of 9% per annum of such Limited Partner’s investment in Partnership (the “Class A Coupon”).

Class A Limited Partners have limited distributions upon disposition of the Property. This tier offers stronger projected cash flow and reduced risk as compared to Class B Limited Partners.

Limited Partner (B) - Class B

Class B Limited Partners earn a coupon of 7% per annum of such Limited Partner’s investment in Partnership (the “Class B Coupon”).

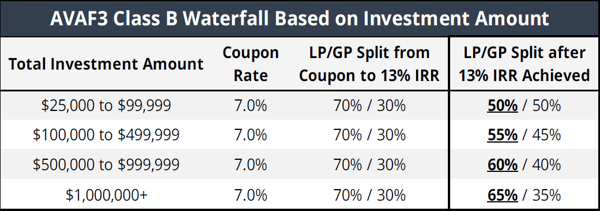

Upon the disposition of the Property, after payment of debt, return of Class A and Class B Limited Partner investments, payment of any unpaid Class A and Class B Coupon Amounts, and then, prorata, seventy percent (70%) to the Class B Limited Partners and thirty percent (30%) to the General Partner until such time as the Class B Limited Partners have received a cumulative amount equal to thirteen percent (13%) IRR. Then, Class B Limited Partners will receive starting at 50% and up to 65%, dependent on the total investment amount, of the remaining proceeds from disposition up. This tier has a lower coupon but provides greater participation upon disposition or capital event compared to Class A Limited Partners.

If you invest more with us, you get more potential upside on your returns. See the structure in the chart below:

Benefits of Investing in a Fund

- Spreads out investor equity over multiple acquisitions

- Greater exposure to investments in various markets and asset classes

- Ability to invest in different individual property business plans and hold periods

- Provides the opportunity to participate in upside on property price appreciation upon sale, refinances, and supplemental loans

- Diversification offers the ability to reduce risks while offering the potential for higher returns

- Potential tax benefits for investors such as pass-through depreciation opportunities and 1031 exchanges