AVAF3 FAQs

Below are frequently asked questions.

FAQs

-

Getting Started

Can you provide some feedback on investing with Ashcroft?

-

Please visit our Investor Perspectives to hear from 100 Ashcroft investors about their experiences.

What is needed to complete my investment?

-

Documents e-signed through our investor portal

-

Valid third-party verification letter of accredited status on file

-

Funds received by our title company

What is the minimum investment?

-

$25,000. Investments over this minimum are accepted in $1,000 increments.

Will there be any incentives for investors who invest more than the $25K required minimum?

-

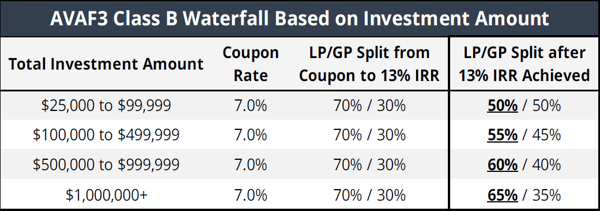

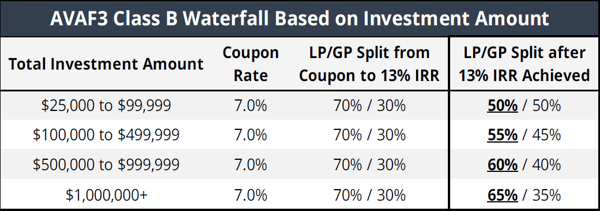

Yes! We are introducing the Ashcroft Incentive Program with the For a limited time we will also be offering Class B investors investing $100K or more in aggregate an increased percentage of cash distributions (“Class B Investment Tiers”) after the thirteen percent (13%) IRR has been achieved.

What are the differences between the AVAF2 and AVAF3 waterfalls?

-

The Ashcroft Incentive Program Class B Investment Tiers return structure provides a higher portion of the profit percentage split to investors who invest larger amounts, but the waterfall structure for Class A and aggregate investment in Class B below $100K maintain the same overall structure as in the AVAF2.

Can I invest with my retirement account (e.g., self-directed IRA or solo 401k)?

-

Yes, as long as your retirement funds are in an account that allows for your investment discretion (i.e., a self-directed IRA that allows real estate private placements).

Can I increase my commitment?

-

Yes, with a minimum increase of $25,000, provided the capital raise period is still open. You would simply sign another subscription agreement, provide an updated verification letter if needed, and fund the increased amount. Your increase would become effective on the first of the following month once all requirements have been met.

Do I have to invest more each time you send out a new deal?

-

You can make your single investment and continue to receive the benefits of exposure to every asset in the fund, but you’re always welcome to increase your investment at any time throughout the capital raise period.

How is my investment treated?

-

Once your investment starts, on the first of the month following completion of the investment, you will have the same exposure and rights as all other Fund investors, regardless of your start date.

-

-

Distributions/ReturnsHow frequently do you pay distributions?

-

We anticipate monthly distributions in AVAF3.

How do Class A and Class B shares differ?

-

Class A will continue to offer a 9% coupon with limited upside. This share class offers stronger projected cash flow and reduced risk compared to Class B Limited Partners.

-

Class B will continue to offer a 7% coupon with more upside potential. Please refer to the Subscription Agreement for details on the promotion structure. This share class offers a lower coupon but provides greater participation upon disposition or capital event compared to Class A Limited Partners.

Will there be any incentives for investors who invest more than the $25K required minimum?

-

Yes! We are introducing the Ashcroft Investment Incentive Program with the AVAF3. For a limited time, we will also be offering Class B investors investing $100K or more in aggregate an increased percentage of cash distributions (“Class B Investment Tiers”) after the thirteen percent (13%) IRR has been achieved.

What are the differences between the AVAF2 and AVAF3 waterfalls?

-

The Ashcroft Investment Incentive Program Class B Investment Tiers return structure provides a higher portion of the profit percentage split to investors who invest larger amounts, but the waterfall structure for Class A and aggregate investment in Class B below $100K maintain the same overall structure as in the AVAF2.

When will my investment begin, and when will my distributions begin?

-

Your investment will begin accruing coupons on the first of the month following the completion of your investment. We anticipate sending your first distribution approximately 60 days after your investment begins. For example, if you complete your investment on December 20, your coupon accrual will begin on January 1, and your first distribution is anticipated to be sent toward the end of February.

What happens if I invest “today,” but your next property doesn’t close for a few months?

-

Investments made in AVAF3 are not tied to the acquisition of new assets but to Closing Dates defined in subscription documents as summarized above. When a Limited Partner invests, the coupon accrual date will begin on the first day of the following month from when the General Partner completes and accepts the subscription, with distributions anticipated to be paid by the end of the following month. For example, if a Limited Partner’s investment is accepted on May 14, the Start Date will be June 1, and the first distribution is anticipated to be sent by the end of July toward June’s operations.

How will distributions occur as assets are sold off?

-

We will distribute the proceeds of the sale of each asset in accordance with the waterfall outlined in the private placement memorandum. For practical purposes, investors are anticipated to receive their share of the proceeds from the sale of each asset as they occur.

How are the monthly distributions calculated throughout the fund?

-

We anticipate distributions to be paid in monthly installments at a 9% annual rate to Class A investors and year one distributions at a 4% annual rate to Class B investors. Please refer to the Fund investment summary package (download here) for projected annualized returns thereafter.

When does “year two” start for my investment?

-

The anniversary of the Fund is based on the final asset acquisition into AVAF3.

How are you benchmarking distributions/returns?

-

We will outline a set of return parameters for the Fund and the Fund investment summary package that align with the asset type we have historically purchased and are continuing to seek for AVAF3.

Are the higher Class B investment tiers taking away from the lower tiers?

-

No. The Ashcroft Investment Incentive Program incentives provided to the larger investment amounts all pertain to the profit percentage split and will only affect the General Partner’s portion of the carried interest and not the Limited Partners of any lower tiers.

Are the Class B Investment Tiers for a single investment or cumulative?

-

Great news! Your investment in AVAF3 will qualify for the Ashcroft Investment Incentive Program based on your total aggregate investment in Class B shares within the AVAF3. For example, if you invest $250,000 in Class B this month, then add another $250,000 in Class B in three months, you would be eligible for the $500,000 Class B Investment Tier terms. Furthermore, Investment Tier qualifications will be based on aggregate Class B investments to include your individual investments, self-directed IRAs, trust accounts, or other investing entities. However, please note that Class A investments are not aggregated. Therefore, if your second investment of $250,000 were in Class A investments would remain in the $100,000 to $499,999 tier.

-

-

Fund OperationsHow many properties do you anticipate will be in the fund?

- We are anticipating acquiring six to ten value-add multifamily assets.

What is the life of the fund?

- We anticipate divesting of all Fund assets within the first seven years. However, we also anticipate several capital events happening much earlier, such as individual property refinances and dispositions in year three and beyond. We did not underwrite this in our projections because we always want to remain conservative, but a capital event could return significant capital back to investors early in the life of the Fund.

What happens if you cannot sell all the assets before the fund ends?

- Just like our single-property investments, we want to make sure that we sell our properties during the best possible time of a real estate cycle. Therefore, we have a defined life of the Fund of seven years plus two one-year extensions. This plan allows adequate time—nearly twice our anticipated hold—to sell the property, while also giving the surety of a defined end date.

What are the fees? Are these different than single-asset deals?

- The fees paid to the General Partner and the Sponsor are as follows:

- Acquisition Fee: 2.85% of purchase price of asset

- Disposition Fee: 1% of sale price of asset

- Financing Fee: 0.50% of the principal amount, only payable if no other brokerage fee is paid to an outside loan broker for the same loan

- Asset Management Fee: 1% of equity raised and outstanding

- Administration Fee: 0.25% of equity raised and outstanding

How much is Ashcroft investing in the fund?

- The Sponsor is committing $1 million initially and adding a minimum of $200,000 per property for each property purchased in the fund.

Will the loans be cross-collateralized within the fund?

- No.

What type of reporting will I receive?

- You will receive monthly email updates by the final Thursday of each month and quarterly financial reports uploaded to your investor portal. You also will receive a K-1, anticipated to be provided by March 31 of each year, also securely uploaded to your investor portal.

How long will you be raising capital?

- We will keep the Fund open until we achieve our equity goal, or 12 months plus one six-month extension, whichever comes first. We anticipate achieving our goal within the initial 12-month period and can close the capital raise period at any point. We recommend investing as soon as you are comfortable to secure a spot.

How long will you be placing the capital?

- We anticipate allocating all of the capital by the end of 2023, if not sooner.

What is my liability as an investor?

- Your liability will be limited to the capital you have invested in the Fund.

Is this an evergreen fund or open-ended fund?

- This is a closed-end fund.

What property management team does Ashcroft use?

- Ashcroft exclusively uses our in-house property and construction management team, Birchstone Residential. We founded Birchstone in 2021 to better control all aspects of our business plan. This relationship has created operational efficiencies that were not possible through third-party management.

How does Birchstone Construction mitigate supply chain issues and control renovation expenses?

- Birchstone Construction sources over one-third of the materials utilized in our renovations directly from manufacturers. We bulk order and warehouse these materials, which allows us enough materials for over 12 months of renovations at any time. By buying in bulk directly from manufacturers, we have achieved nearly 35% savings on materials.

-

Tax MattersHow are taxes treated?

-

Ashcroft is not a tax advisor, so we recommend you contact your tax advisor to understand your specific case. You will receive a single federal K-1 and a single state K-1 for each income tax state in which we own assets. We will continue to operate the assets in the most tax-advantageous way possible, including the use of cost segregation studies.

How will you handle states with income tax?

-

Ashcroft is not filing a composite return because investors can potentially use the losses passed through. Please consult your tax advisor on the specific application of the losses and whether you are required to file an out-of-state tax return. In the year of the taxable event, Ashcroft will determine if a composite filing is needed.

-

-

Liquidity/DispositionsWill I be able to get my money out before you sell all the assets?

-

Your investment will be considered an illiquid investment, so anticipate that your capital will be committed throughout the life of the Fund. But we will be distributing proceeds from sales and refinances according to the waterfall, and we anticipate achieving both throughout the Fund, likely creating early capital events.

Can I 1031 exchange my investment?

-

We cannot accept 1031 proceeds into the Fund. Our goal is to offer investors the opportunity to 1031 their portion of proceeds out of the Fund into another Ashcroft investment, which may defer realization of gains. If Ashcroft offers the Limited Partners the opportunity to participate in a 1031 or similar exchange, this election will take place at the time of disposition of any single asset within the Fund.

-

Disclaimer: This document is for informational purposes only and is not intended for any other use. This document is not an offering memorandum or prospectus and should not be treated as offering material of any sort. The information contained in this document shall not constitute an offer to sell or the solicitation of an offer to buy securities. This document is intended to be of general interest only and does not constitute or set forth professional opinions or advice. Actual information and results may differ materially from those stated in the offering documents.

Ashcroft is not an investment adviser or a broker-dealer and is not registered with the US Securities and Exchange Commission. The information in this FAQ should not be used as the sole basis of any investment decisions, nor is it intended to be used as advice with respect to the advisability of investing in, purchasing, or selling securities, nor should it be construed as advice designed to meet the investment needs of any particular person, entity, or specific investment situation. None of the information contained herein.

Start Investment Process

Ashcroft Capital offerings are limited to accredited investors.

Learn more about our investor criteria.

Want To Learn More?

Schedule a 1-on-1 call with a member of our investor relations team to learn more.

Disclaimer: This investment will be filled on a first-come, first--fund basis and is open to accredited investors only. All investment information will be made available in the investor portal. Ashcroft Capital LLC is not an investment adviser or a broker-dealer and is not registered with the U.S. Securities and Exchange Commission. The information presented herein should not be used as the sole basis of any investment decisions, nor is it intended to be used as advice with respect to the advisability of investing in, purchasing or selling securities, nor should it be construed as advice designed to meet the investment needs of any particular person or entity or any specific investment situation. None of the information presented herein constitutes legal, accounting or tax advice or individually tailored investment advice. The recipient of this information assumes responsibility for conducting its own due diligence and assumes full responsibility of any investment decisions.