Midtown 501

Chapel Hill, NC

Part of the Ashcroft Value-Add Fund III

Built in 1975

Renovated 2015

Value-Add Plan

Investment Summary

The Apartments at Midtown 501 (the “Property” and “Midtown501”) is the first acquisition within the Ashcroft Value-Add Fund III. The Property consists of 248-units and is located in highly affluent Chapel Hill submarket of Raleigh, North Carolina. Midtown 501 was originally built in 1975, however, current ownership completed a $15 million ($60,000 per unit) extensive transformation of the property in 2015 which fully modernized the amenities, units, and physical attributes of the asset. Leaving only minimal deferred maintenance remaining, Midtown 501 provides Ashcroft the opportunity to focus efforts on operational improvements and maximizing income through light interior upgrades.

Ready to Get Started?

Schedule a 1-on-1 call with a member of our investor relations team to learn more. During this call, we will discuss your investment goals, tell you more about our company, and answer any questions you may have about our most recent investment offering. We look forward to assisting you with your passive investing journey.

Targeted Fund Returns*

|

Cash-on-Cash Returns 13% to 20% |

Cash on Cash Returns 6.8% to 8.0% |

|

Levered IRR (Net) 13% to 18% |

Equity Multiple (Net) 1.45x to 2.0x |

Annual Cash-on-Cash Projections**

|

Year 1: 4.0% |

Year 2: 6.3% |

Year 3: 7.0% |

Year 4: 7.5% |

Year 5: 8.0% |

*Based on 5 year hold for Class B Limited Partner Investment. Target returns represent ranges for base case, downside, and upside scenarios.

**Projected cash on cash returns are based on base case assumptions for the properties within the Fund

Note: Projected returns are based on LP levels of Fund

Return Structure

Investors have the opportunity to invest in Class A and/or Class B Limited Partnership Interests.

Limited Partner (A) - Class A

Class A Limited Partner’s earn a coupon of 9% per annum of such Limited Partner’s investment in Partnership (the “Class A Coupon”). Class A Limited Partners have limited distributions upon disposition of the Property. This tier offers stronger projected cash flow and reduced risk as compared to Class B Limited Partners.

Limited Partner (B) - Class B

Class B Limited Partners earn a coupon of 7% per annum of such Limited Partner’s investment in Partnership (the “Class B Coupon”).

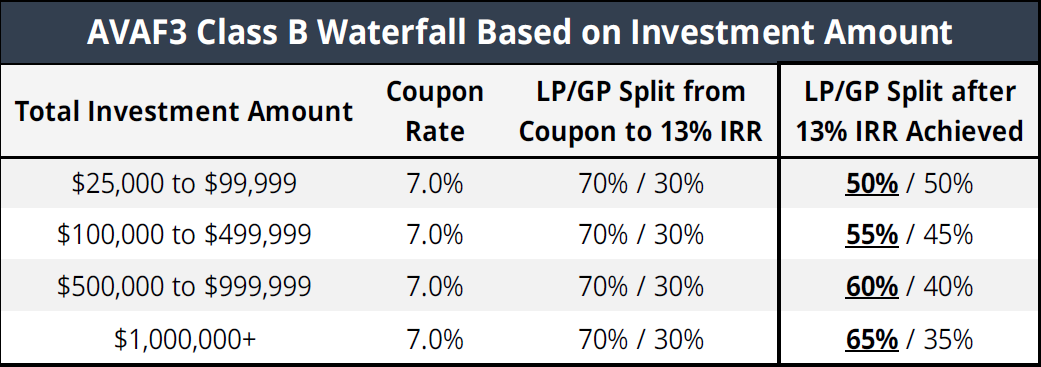

Upon the disposition of the Property, after payment of debt, return of Class A and Class B Limited Partner investments, payment of any unpaid Class A and Class B Coupon Amounts, and then, prorata, seventy percent (70%) to the Class B Limited Partners and thirty percent (30%) to the General Partner until such time as the Class B Limited Partners have received a cumulative amount equal to thirteen percent (13%) IRR. Then, Class B Limited Partners will receive starting at 50% and up to 65%, dependent on the total investment amount, of the remaining proceeds from disposition up. This tier has a lower coupon but provides greater participation upon disposition or capital event compared to Class A Limited Partners.

If you invest more with us, you get more potential upside on your returns. See the structure in the chart below:

Understanding the

Benefits of Investing in a Fund

- Spreads out investor equity over multiple acquisitions

- Greater exposure to investments in various markets and asset classes

- Ability to invest in different individual property business plans and hold periods

- Provides the opportunity to participate in upside on property price appreciation upon sale, refinances, and supplemental loans

- Diversification offers the ability to reduce risks while offering the potential for higher returns

- Potential tax benefits for investors such as pass-through depreciation opportunities and 1031 exchanges

Disclaimer: Ashcroft is not an investment adviser or a broker-dealer and is not registered with the U.S. Securities and Exchange Commission. The information on this website should not be used as the sole basis of any investment decisions, nor is it intended to be used as advice with respect to the advisability of investing in, purchasing or selling securities, nor should it be construed as advice designed to meet the investment needs of any particular person or entity or any specific investment situation. None of the information contained herein constitutes legal, accounting or tax advice or individually tailored investment advice. The reader assumes responsibility for conducting his/her own due diligence and assumes full responsibility of any investment decisions.

About Ashcroft Capital

Ashcroft Capital focuses on capital preservation while striving to return strong, risk-adjusted cash on cash to investors. The firm specializes in value-add real estate and has an expertise in extracting maximum value from every asset it acquires.